Fluent in the Future

Building Connections That Set Ideas Free

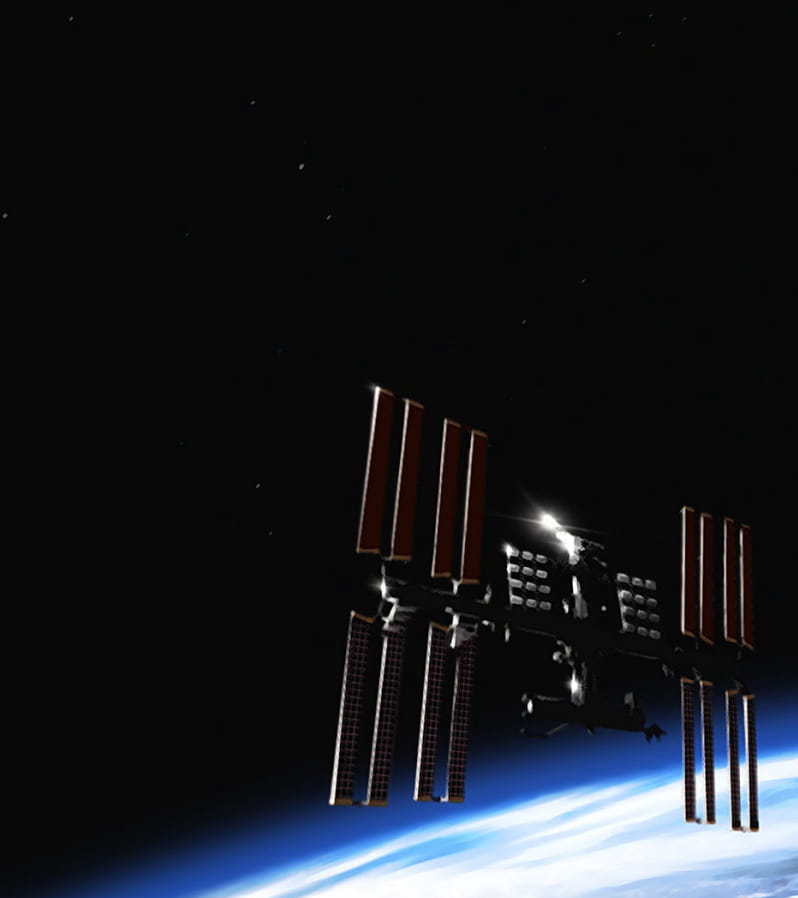

Terrestrial and satellite communications have long existed as independent domains, with distinct products, capabilities, and infrastructures.

We envisioned a future beyond those boundaries – a future of hybridized connectivity.

Our Capabilities

Making Hybridized Connectivity A Global Reality

A Culture of Innovation

“Comtech’s innovative culture is what defines us. We have a clear vision: relentlessly pursuing a better way to connect everything and everyone.”

John Ratigan

Interim CEO